Automated Investing For The Data Driven Investor

Automated Investing

For The Data

Driven Investor

DIVITAE offers investors access to institutional-grade, algorithmic strategies designed for resilience, risk control, and long-term capital preservation.

Harness The Liquidity Pool Of Our Institutional Partners:

Harness The Liquidity Pool Of Our Institutional Partners:

Harness The Liquidity Pool Of Our Institutional Partners:

ABOUT US

ABOUT US

Where Human Approach Meets Artifical Intelligence.

With algorithmic precision, transparent structure, and investor-first alignment, Divitae stands at the forefront of a smarter financial future.

Cutting Edge Trading Algorithms

We use proprietary quant systems to process millions of signals in real time. This helps us spot asymmetric opportunities before the market reacts.

Cutting Edge Trading Algorithms

We use proprietary quant systems to process millions of signals in real time. This helps us spot asymmetric opportunities before the market reacts.

Cutting Edge Trading Algorithms

We use proprietary quant systems to process millions of signals in real time. This helps us spot asymmetric opportunities before the market reacts.

Access to Diverse Strategies

Forex. Metals. Crypto. Alternatives. Our edge comes from flexibility and strategic diversity, because alpha isn’t one-size-fits-all.

Access to Diverse Strategies

Forex. Metals. Crypto. Alternatives. Our edge comes from flexibility and strategic diversity, because alpha isn’t one-size-fits-all.

Access to Diverse Strategies

Forex. Metals. Crypto. Alternatives. Our edge comes from flexibility and strategic diversity, because alpha isn’t one-size-fits-all.

Personalized Approach

We design every portfolio around your goals and risk profile. One call is all it takes to build a smarter path to scale.

Personalized Approach

We design every portfolio around your goals and risk profile. One call is all it takes to build a smarter path to scale.

Personalized Approach

We design every portfolio around your goals and risk profile. One call is all it takes to build a smarter path to scale.

Effortless Onboarding

Get started in minutes. Choose your strategy. Stay liquid. Everything is designed to move with you, not against you.

Effortless Onboarding

Get started in minutes. Choose your strategy. Stay liquid. Everything is designed to move with you, not against you.

Effortless Onboarding

Get started in minutes. Choose your strategy. Stay liquid. Everything is designed to move with you, not against you.

Powerful Features

Powerful Features

Powerful Features

Why Experienced Investors Choose Divitae?

Everything you need to automate, optimize, and scale.

Everything you need to automate,

optimize, and scale.

FCA-Regulated Partners

Our partners include Pelican (London & Eastern LLP), authorised and regulated by the UK FCA with additional CySEC and Mauritius FSC permissions; Vantage, a globally regulated multi-asset broker serving 5M+ clients across 172 countries; and MAS Markets, an FCA-regulated global liquidity provider offering bespoke execution, liquidity, and technology solutions.

FCA-Regulated Partners

Our partners include Pelican (London & Eastern LLP), authorised and regulated by the UK FCA with additional CySEC and Mauritius FSC permissions; Vantage, a globally regulated multi-asset broker serving 5M+ clients across 172 countries; and MAS Markets, an FCA-regulated global liquidity provider offering bespoke execution, liquidity, and technology solutions.

FCA-Regulated Partners

Our partners include Pelican (London & Eastern LLP), authorised and regulated by the UK FCA with additional CySEC and Mauritius FSC permissions; Vantage, a globally regulated multi-asset broker serving 5M+ clients across 172 countries; and MAS Markets, an FCA-regulated global liquidity provider offering bespoke execution, liquidity, and technology solutions.

AI Strategies

Our process uses years of research into market behavior and systemic inefficiencies to power models that react to recurring patterns with disciplined risk controls, delivering a repeatable, unemotional approach that removes guesswork and compounds capital over time.

AI Strategies

Our process uses years of research into market behavior and systemic inefficiencies to power models that react to recurring patterns with disciplined risk controls, delivering a repeatable, unemotional approach that removes guesswork and compounds capital over time.

AI Strategies

Our process uses years of research into market behavior and systemic inefficiencies to power models that react to recurring patterns with disciplined risk controls, delivering a repeatable, unemotional approach that removes guesswork and compounds capital over time.

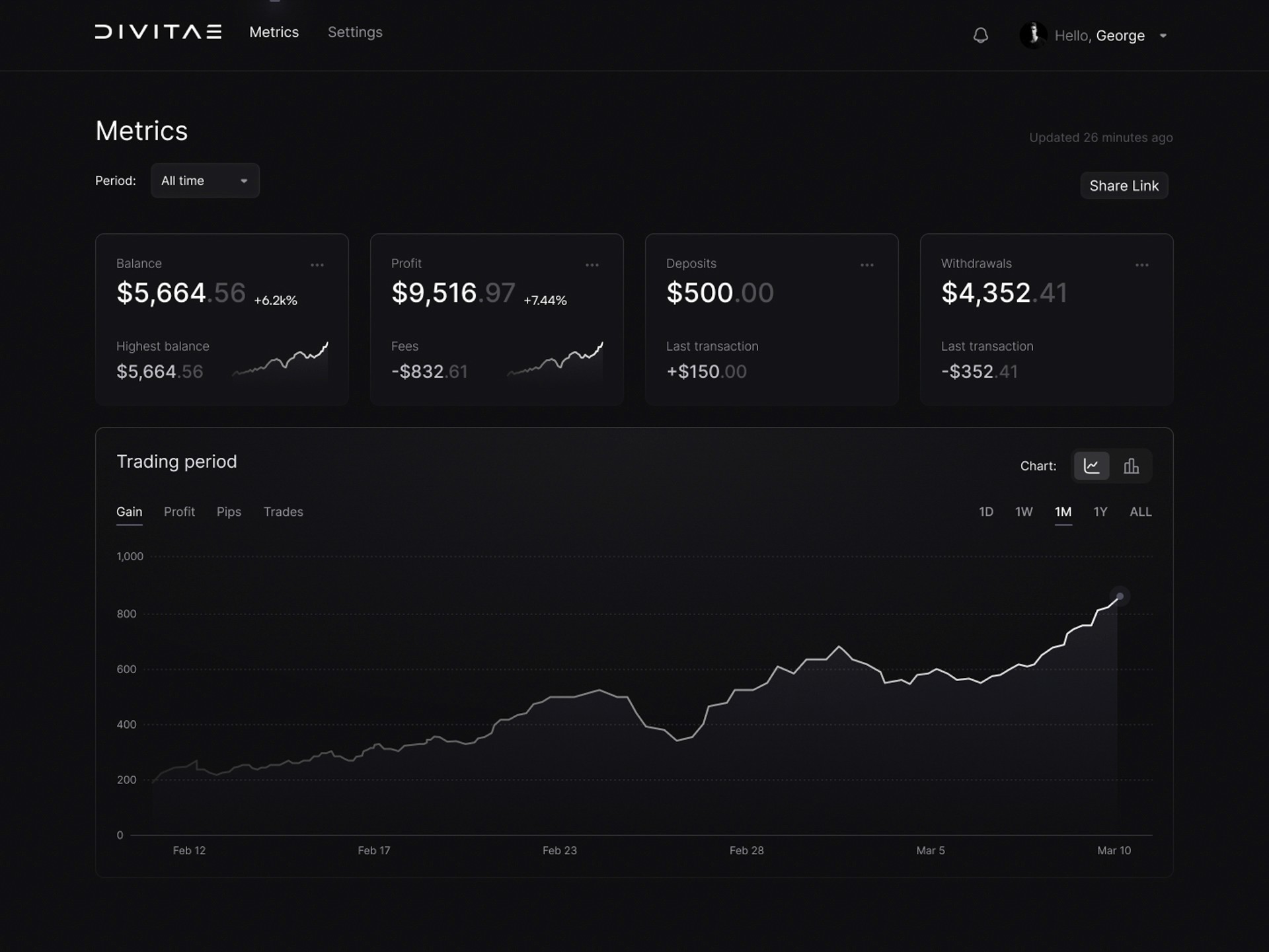

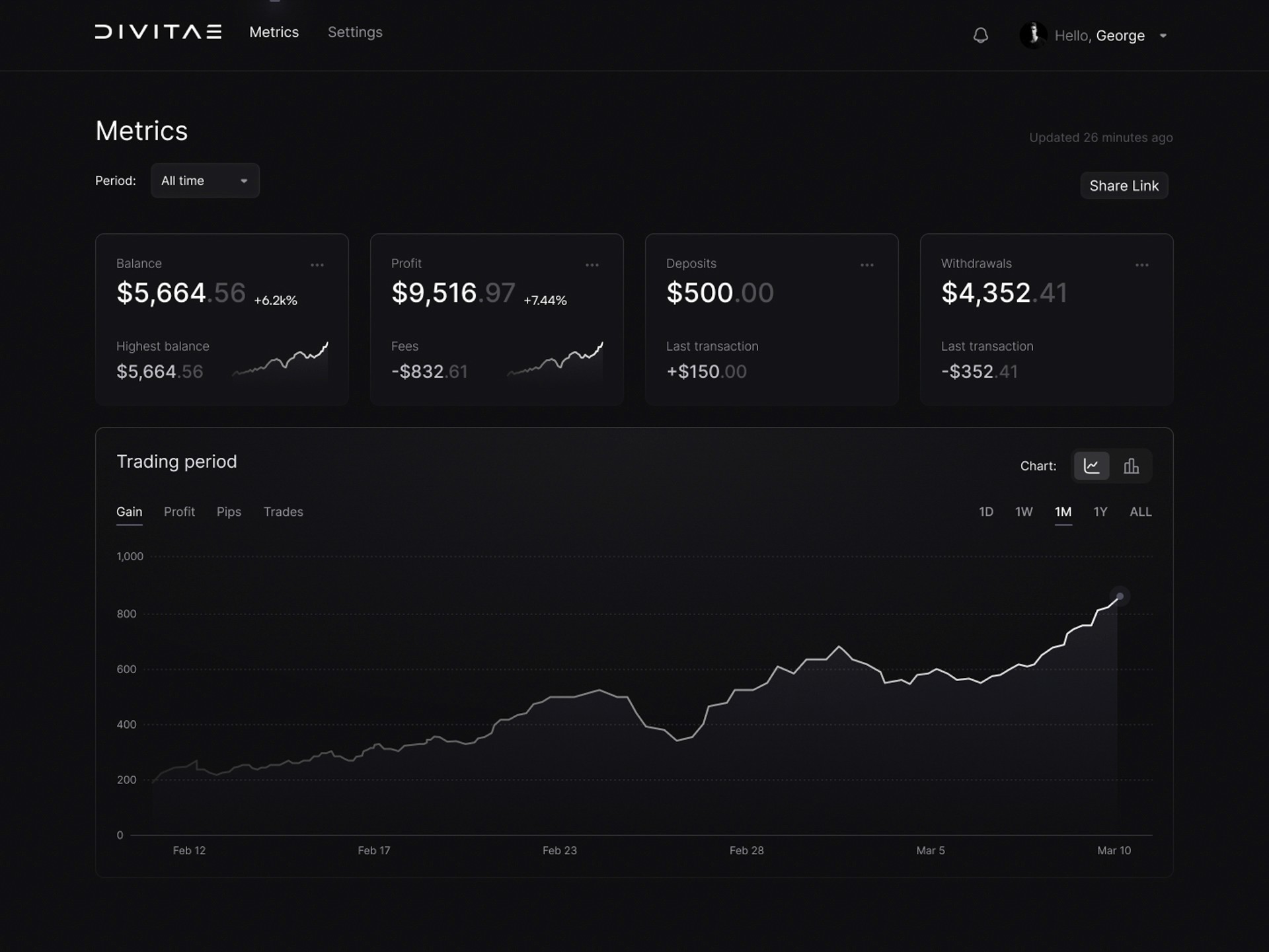

Investor Dashboard

Through our desktop investor portal and dedicated mobile app, you can seamlessly monitor real-time performance metrics, giving you full visibility into your investments at all times.

Investor Dashboard

Through our desktop investor portal and dedicated mobile app, you can seamlessly monitor real-time performance metrics, giving you full visibility into your investments at all times.

Investor Dashboard

Through our desktop investor portal and dedicated mobile app, you can seamlessly monitor real-time performance metrics, giving you full visibility into your investments at all times.

Consistent Outperformance, Without the Risk Chasing

Our strategies averaged 46.11% annually over the past three years, outperforming major benchmarks including the Nasdaq, Gold, S&P 500, and MSCI World.

Consistent Outperformance, Without the Risk Chasing

Our strategies averaged 46.11% annually over the past three years, outperforming major benchmarks including the Nasdaq, Gold, S&P 500, and MSCI World.

Consistent Outperformance, Without the Risk Chasing

Our strategies averaged 46.11% annually over the past three years, outperforming major benchmarks including the Nasdaq, Gold, S&P 500, and MSCI World.

Benefits

Benefits

Benefits

Benefits For Investors

Gain diversified exposure to multiple strategies, unlock selective deals, and receive transparent reporting - aiming for superior, risk-adjusted returns.

Gain diversified exposure to multiple strategies, unlock selective deals, and receive transparent reporting - aiming for superior, risk-adjusted returns.

Diversified Exposure

Access to Exclusive Opportunities

Transparency and Reporting

Potential for High Returns

Process

Process

Process

Onboarding For Investors.

Our onboarding process is designed for experienced investors who value clarity, control, and personalisation. From registration to allocation, each step is transparent - and if desired, supported by direct access to our team for strategy walkthroughs, risk discussions, and detailed answers.

Step 1

Account Registration

Begin by creating an account on our Investor Dashboard. This platform is designed to provide you with a seamless and secure investment experience.

Step 1

Account Registration

Begin by creating an account on our Investor Dashboard. This platform is designed to provide you with a seamless and secure investment experience.

Step 1

Account Registration

Begin by creating an account on our Investor Dashboard. This platform is designed to provide you with a seamless and secure investment experience.

Step 2

Select Your Strategy

Browse through our diverse range of Strategies. Each strategy has detailed descriptions to help you understand its focus and performance history, ensuring you make an informed decision that aligns with your investment goals.

Step 2

Select Your Strategy

Browse through our diverse range of Strategies. Each strategy has detailed descriptions to help you understand its focus and performance history, ensuring you make an informed decision that aligns with your investment goals.

Step 2

Select Your Strategy

Browse through our diverse range of Strategies. Each strategy has detailed descriptions to help you understand its focus and performance history, ensuring you make an informed decision that aligns with your investment goals.

Step 3

Application Submission

Once you’ve chosen your strategy, complete and submit your application directly through the dashboard. This step involves verifying your details and setting up your investment preferences.

Step 3

Application Submission

Once you’ve chosen your strategy, complete and submit your application directly through the dashboard. This step involves verifying your details and setting up your investment preferences.

Step 3

Application Submission

Once you’ve chosen your strategy, complete and submit your application directly through the dashboard. This step involves verifying your details and setting up your investment preferences.

Step 4

Investment

After your application is approved, you can proceed to invest. Our platform offers straightforward options for transferring funds, allowing you to start capitalising on your chosen investment strategy without delay.

Step 4

Investment

After your application is approved, you can proceed to invest. Our platform offers straightforward options for transferring funds, allowing you to start capitalising on your chosen investment strategy without delay.

Step 4

Investment

After your application is approved, you can proceed to invest. Our platform offers straightforward options for transferring funds, allowing you to start capitalising on your chosen investment strategy without delay.

Strategies

Strategies

Strategies

Select a Strategy

Risk-adjusted strategies built for preservation, income, or growth.

ZEUS

An institutional-grade, multi-strategy trading system that allocates capital across a broad set of uncorrelated FX and commodity subsystems using genetic optimisation and machine-learning-driven correlation analysis. It is designed to prioritise diversification, risk stability, and durable risk-adjusted returns across market regimes.

Minimum Investment

$500

12 Month ROI

26.72%

Total Return Cumulative

950.04%

Max Drawdown

-14.88%

ARES

A high-performance, systematic trading strategy that dynamically deploys capital across 30+ uncorrelated FX and commodity subsystems using advanced genetic optimisation and ML-based filtering. Built to maximise risk-adjusted returns while maintaining strict volatility and drawdown control with low equity market correlation.

Minimum Investment

$500

12 Month ROI

51.92%

Total Return Cumulative

359.59%

Max Drawdown

-14.20%

HERMES

A compact, high-intensity FX trading system that allocates capital across a tightly vetted portfolio of subsystems using genetic optimisation, advanced correlation analysis, and machine-learning ensemble filtering. It targets higher return potential with controlled volatility and frequent trade activity, suitable for smaller account sizes without sacrificing institutional discipline.

Minimum Investment

$500

12 Month ROI

157.59%

Total Return Cumulative

320.78%

Max Drawdown

-11.20%

KRONOS

A systematic crypto trading strategy engineered to exploit structural inefficiencies in BTC and ETH through high-frequency pattern recognition and genetic capital allocation. It dynamically distributes risk across multiple independent subsystems to maintain capital efficiency and robustness in highly volatile digital asset markets.

Minimum Investment

$500

12 Month ROI

9.97%

Total Return Cumulative

612.60%

Max Drawdown

-17.26%

ZEUS

An institutional-grade, multi-strategy trading system that allocates capital across a broad set of uncorrelated FX and commodity subsystems using genetic optimisation and machine-learning-driven correlation analysis. It is designed to prioritise diversification, risk stability, and durable risk-adjusted returns across market regimes.

Minimum Investment

$500

12 Month ROI

26.72%

Total Return Cumulative

950.04%

Max Drawdown

-14.88%

ARES

A high-performance, systematic trading strategy that dynamically deploys capital across 30+ uncorrelated FX and commodity subsystems using advanced genetic optimisation and ML-based filtering. Built to maximise risk-adjusted returns while maintaining strict volatility and drawdown control with low equity market correlation.

Minimum Investment

$500

12 Month ROI

51.92%

Total Return Cumulative

359.59%

Max Drawdown

-14.20%

HERMES

A compact, high-intensity FX trading system that allocates capital across a tightly vetted portfolio of subsystems using genetic optimisation, advanced correlation analysis, and machine-learning ensemble filtering. It targets higher return potential with controlled volatility and frequent trade activity, suitable for smaller account sizes without sacrificing institutional discipline.

Minimum Investment

$500

12 Month ROI

157.59%

Total Return Cumulative

320.78%

Max Drawdown

-11.20%

KRONOS

A systematic crypto trading strategy engineered to exploit structural inefficiencies in BTC and ETH through high-frequency pattern recognition and genetic capital allocation. It dynamically distributes risk across multiple independent subsystems to maintain capital efficiency and robustness in highly volatile digital asset markets.

Minimum Investment

$500

12 Month ROI

9.97%

Total Return Cumulative

612.60%

Max Drawdown

-17.26%

ZEUS

An institutional-grade, multi-strategy trading system that allocates capital across a broad set of uncorrelated FX and commodity subsystems using genetic optimisation and machine-learning-driven correlation analysis. It is designed to prioritise diversification, risk stability, and durable risk-adjusted returns across market regimes.

Minimum Investment

$500

12 Month ROI

26.72%

Total Return Cumulative

950.04%

Max Drawdown

-14.88%

ARES

A high-performance, systematic trading strategy that dynamically deploys capital across 30+ uncorrelated FX and commodity subsystems using advanced genetic optimisation and ML-based filtering. Built to maximise risk-adjusted returns while maintaining strict volatility and drawdown control with low equity market correlation.

Minimum Investment

$500

12 Month ROI

51.92%

Total Return Cumulative

359.59%

Max Drawdown

-14.20%

HERMES

A compact, high-intensity FX trading system that allocates capital across a tightly vetted portfolio of subsystems using genetic optimisation, advanced correlation analysis, and machine-learning ensemble filtering. It targets higher return potential with controlled volatility and frequent trade activity, suitable for smaller account sizes without sacrificing institutional discipline.

Minimum Investment

$500

12 Month ROI

157.59%

Total Return Cumulative

320.78%

Max Drawdown

-11.20%

KRONOS

A systematic crypto trading strategy engineered to exploit structural inefficiencies in BTC and ETH through high-frequency pattern recognition and genetic capital allocation. It dynamically distributes risk across multiple independent subsystems to maintain capital efficiency and robustness in highly volatile digital asset markets.

Minimum Investment

$500

12 Month ROI

9.97%

Total Return Cumulative

612.60%

Max Drawdown

-17.26%

Past performance is no guarantee of future returns.

FAQ

FAQ

FAQ

Frequently Asked Questions

Who are we, and what services does DIVITAE provide?

What are the benefits of investing with DIVITAE?

What is the minimum investment required?

How long should I invest for optimal returns?

How do I get started with DIVITAE?

Still have a question?

Get in touch with us and let's discuss it.

Who are we, and what services does DIVITAE provide?

What are the benefits of investing with DIVITAE?

What is the minimum investment required?

How long should I invest for optimal returns?

How do I get started with DIVITAE?

Still have a question?

Get in touch with us and let's discuss it.

Who are we, and what services does DIVITAE provide?

What are the benefits of investing with DIVITAE?

What is the minimum investment required?

How long should I invest for optimal returns?

How do I get started with DIVITAE?

Still have a question?

Get in touch with us and let's discuss it.

Get Started

Get Started

Get Started

Automate Your Investments

Ready to take the next step? Contact us to schedule a consultation and learn how we can help you achieve your investment goals.